Eligibility and General Information

Below is an overview of some of the Plan’s key eligibility provisions. For complete details regarding establishing and maintaining coverage under the Plan, please refer to the Eligibility Requirements section of the Health Benefits Plan booklet or contact the Administrator.

Establishing Coverage

All Union members in good standing, and their dependents, are covered for the Employee and Family Assistance Plan.

Eligibility for all other benefits requires that you:

- Are a member in good standing of Local 2404;

- Have a minimum of 200 hours, within a period of six consecutive months, reported and paid into the Plan by your employer(s).

Member coverage will commence on the first day of the month following the month in which the above conditions are met. Coverage for your Dependents will be effective only after you complete the applicable application forms and file them with the Plan Office.

How to Enrol in the Plan

To enroll in the Health Benefits Plan you must complete the following forms and send them to the Administrator without delay:

- Enrolment Application for Group Benefits

- Life and AD&D Beneficiary Designation

- MSP Application for Group Enrolment

- Common Law Declaration (if applicable)

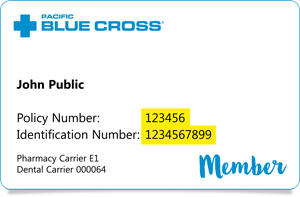

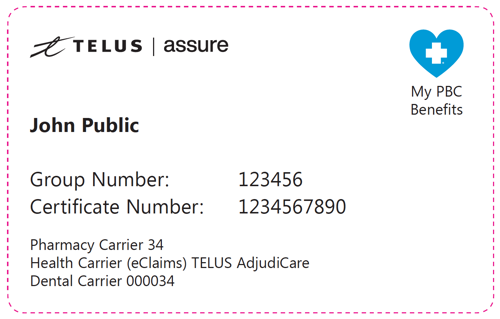

Once you are enrolled in the Plan, you will receive a Member ID card. Two cards will be issued if you have dependent coverage.

Coverage for Dependents

Your eligible dependents will be covered for Extended Health and Dental benefits. Please refer to the Health Benefits Plan booklet for the definition of eligible dependent.

You must advise the Administrator of any change related to your dependents to ensure they have access to benefits. If you are adding a Common-Law spouse after your initial eligibility date, the notarized Common-Law Declaration is required.

If your spouse has their own coverage through their employment or union, please refer to the Extended Health and Dental sections of the Health Benefits Plan booklet for information regarding Coordination of Benefits.

Maintaining Coverage

The Plan operates on an hour bank system. Hours are reported monthly by your employer(s) and accumulated in your own personal hour bank. Once you have qualified for coverage, 100 hours are deducted from your hourbank each month to provide your coverage.

You may accumulate up to maximum of 1,200 hours (12 months of future coverage) in your hour bank in order to continue your coverage through periods of low employment, unemployment or vacation, provided you remain a member in good standing.

If you are collecting short term disability, Employment Insurance sickness benefits, or WCB wage loss benefits you may be eligible for special credits to maintain your hourbank. Please refer to the In Case of Injury or Illness section of the Health Benefits Plan booklet or contact the Administrator for more information.

If your hour bank falls below 100 hours, you may be eligible to continue your coverage under the self-payment option as described below.

Self-payment

If you are a member in good standing but do not have enough hours for coverage, you may continue your coverage through self-payment. You will not have Short Term Disability or Long Term Disability coverage while you are self-paying.

A self-payment notice will be sent to you at the last known address that is on file with the Administrator. You should not ignore this notice if you wish to remain covered. You must pay the amount indicated on the notice by the deadline date in order to maintain your coverage. If you do not respond to the self-payment notice, you will not be sent another notice the following month.

The maximum number of self-payments allowed is 12 consecutive months.

Termination of Coverage

Your coverage will terminate when:

- Your hour bank falls below 100 hours, and you fail to make a self-payment by the specified date, or

- You reach the maximum number of self-payments, or

You cease to be a member in good standing of the Union